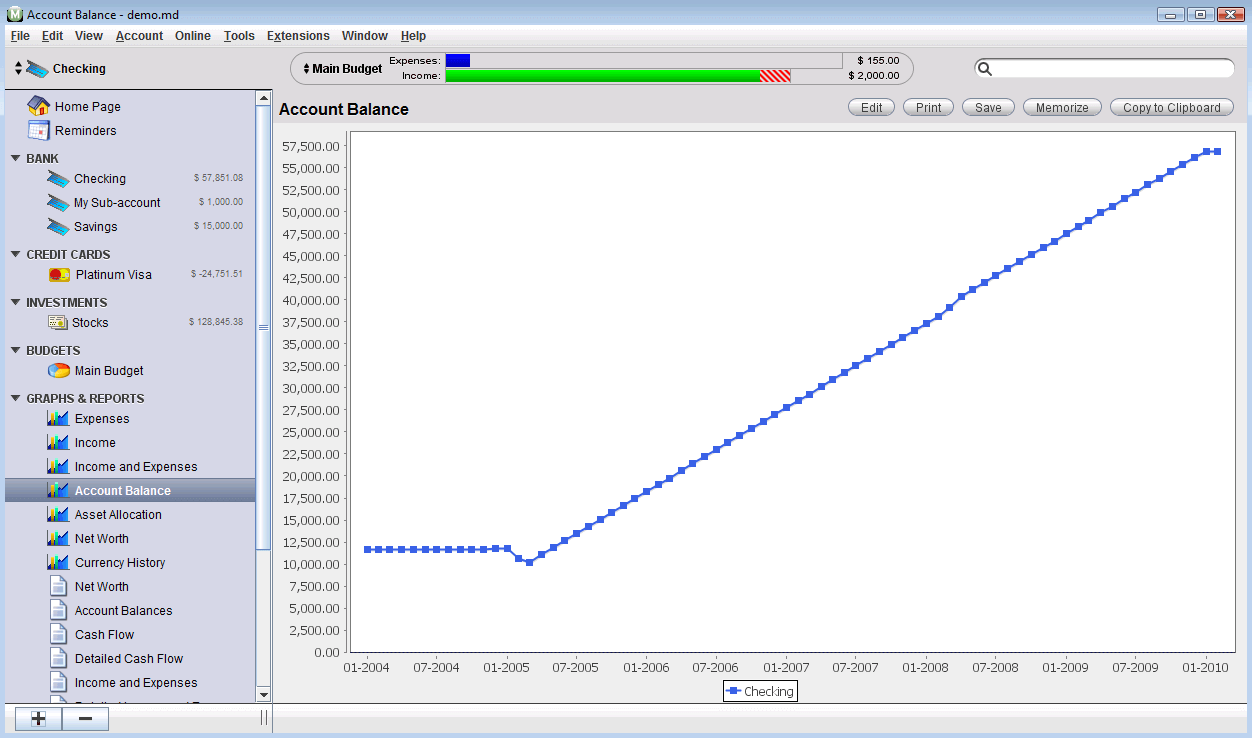

It can show your current state, various graphs, and provide downloads of all that data.” “Moneydance will do all your calculations for you - your capital gains, your cost basis. “It doesn’t just store your current portfolio balance and value, it tracks your whole history,” Reilly said. And the program includes a budgeting system that Reilly said employs the best features of various budgeting mechanisms on the market.Īdditionally, users can access robust investment support. Reilly said Moneydance can also provide online bill payment functionality for the banks that support the software. Selecting a specific account will take the user to the account registry where he or she can manually enter transactions or reconcile the account against a statement.

Users can also access a convenient overview of their finances for multiple accounts that includes account balances, upcoming transactions, reminders, and exchange rate information.

MONEYDANCE REVIEWS HOW TO

“It learns how to automatically categorize and clean up downloaded transactions.” “Moneydance can automatically download transactions and send payments online from hundreds of financial institutions,” according to the Moneydance website. Moneydance includes features of big-name personal finance programs but with a greater focus on privacy. Consumers were able to manage their finances with powerful tools that had previously been available only to financial professionals.

MONEYDANCE REVIEWS SOFTWARE

Personal finance software was as ubiquitous as the software that helped users get online for the first time, often coming in a software bundle accompanying new computers. And, in the mid-to-late ‘90s, home computing software - often installed via CD-ROM - was seemingly everywhere. The number of households with home computers increased from 15% to 35% between 19. If elementary students in the year 2097 were to open a time capsule to learn what life had been like a century before, they would likely find an AOL CD-ROM sitting atop the capsule’s contents. And, with its multicurrency mechanism, Moneydance is particularly useful for customers dealing with multiple foreign accounts or cryptocurrency. While many personal finance applications utilize a third party to interface with banks, the Moneydance software interacts directly with financial institutions to ensure vital information remains with the customer. The software boasts a robust set of features, including online banking, bill payment, account management, and investment tracking. In a Nutshell: Moneydance was among the first competitors to the biggest names in personal finance software, providing tools for complete financial management while maintaining a focus on privacy and the user experience.

0 kommentar(er)

0 kommentar(er)